Trade dynamics have shifted considerably since President Trump’s first administration. Reshoring among U.S. businesses and headwinds to the Chinese economy may limit the inflationary impact from rogue trade policy.

It’s a Whole New World

One of the biggest fears for investors right now is the resurgence of inflation from adverse effects of Trump’s potential trade policy. Also worth mentioning, general market uncertainty is building, thanks to an over eager Federal Reserve (Fed) who did a super-size jumbo cut in September, paving the way for markets to be disoriented about the Fed’s future path.

If the Fed is data dependent, the larger cut was likely unwarranted as the economy was growing above trend. Many investors thought the Fed should have adjusted rates by 0.25 percentage point instead of the half-point cut. And now, Fed Chair Jerome Powell said they are in no hurry to cut rates, causing markets to reprice expectations for 2025. In addition to the inherent risks of data dependency in an era of data revisions, investors are also working through the possibility that trade wars will incite an inflation resurgence.

The argument is tariffs bring about higher consumer prices, which could be true — but only if all other considerations are held constant. That assumes businesses pass along the cost, and supply chains are cemented down.

A tariff is a type of tax, so who will likely bear the brunt of that burden? Would it be the end consumer, the domestic importer, or the foreign producer? It’s likely a combination of all three but in this piece, we argue that the current macro landscape increases the chances that foreign firms will likely bear more — but obviously not all — of the cost.

At Least Three Things Are Different Now

We can be sure of at least three things that are different now than during the first Trump administration.

First, the tables have turned when it comes to growth between the U.S. and China. Now, China is in a more vulnerable economic position than before. Their corporate and household debt burdens are much higher than in the U.S., Chinese consumer demand is softer, and their real estate market is floundering. As investors anticipate what upcoming trade policy could do to the U.S. economy and domestic inflation, we should consider the economic environment. In 2018, the U.S. economy was slowing down from a near-term peak of almost 6% year-over-year growth to 3.8%, whereas the Chinese economy was steaming along at a steady 7% growth rate (Figure 1). Times have certainly changed since then for the Chinese economy, and their weakness gives the U.S. certain negotiating power in trade discussions as foreign firms work to keep up steady business.

Major Role Reversals Between China and the U.S.

China Is Weaker Now Than During Trump 1.0

Source: Source: LPL Research, Census Bureau, 11/12/24

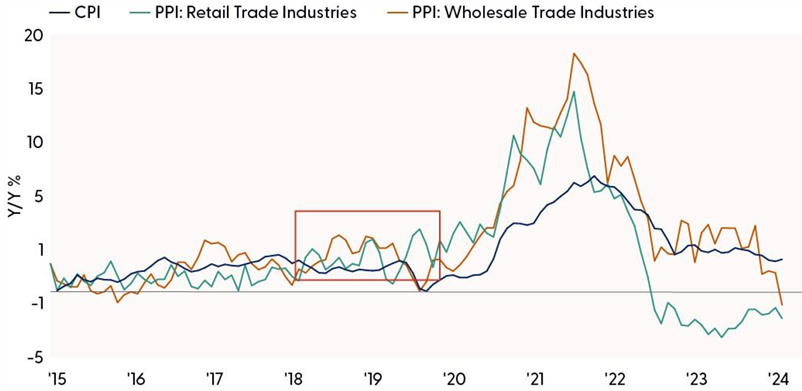

Second, producer prices are outright falling now versus the choppy experience around 2018. It’s also important to highlight that producer prices do not always track consumer prices. Without a doubt, these series correlate, but the relationship is far from a one-for-one. During Trump’s first administration, producer prices for the wholesale and retail industries were volatile as businesses managed supply chains amid a trade war, but consumers did not necessarily feel the full brunt. So, who bears the cost of the tax? It’s not always fully borne by domestic consumers. According to a National Bureau of Economic Research (NBER) paper, foreign countries bore “close to half the cost of the steel tariffs” in 2018.¹ Of course, there are two very important considerations to include in the analysis: exclusions and item-specific markets.

During Trump’s first presidency, he granted exclusions for over 2,200 products based on the businesses’ argument that tariffs cause considerable harm, or the foreign product is not available in the U.S. Ironically, President Biden kept most of Trump’s tariffs and put additional tariffs in place in May of this year.²

The consumer impacts from tariffs vary widely and are industry-specific, as businesses often apply for exclusions or bear part of the costs. Consumer prices surprisingly decelerated down to 1.7% in late 2019 after businesses adjusted to the trade war with China (Figure 2).

Producer Prices (PPI) Don’t Always Track with CPI

Importers Didn’t Fully Pass Along Tariffs of 2018-2019

Source: LPL Research, Bureau of Labor Statistics, 11/14/24

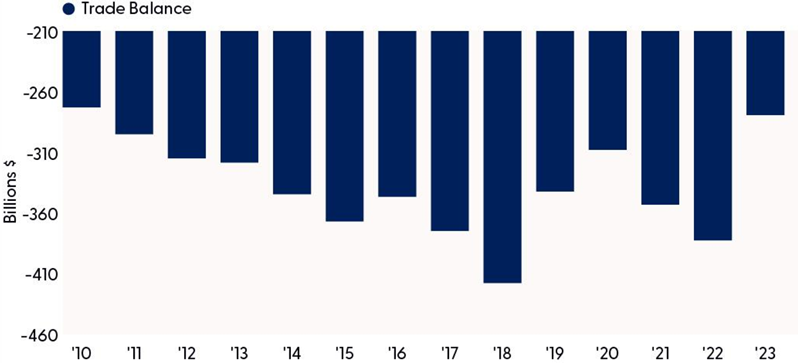

Third, trade deficits are narrower now. Because of reshoring and other factors, the deficit with China is the lowest since 2010 and significantly better than the depths of 2018. In 2023, the deficit shrunk to -$279 billion, which was a 17% decrease in total trade with China compared to 2022 (Figure 3). As U.S. businesses have diversified their reliance on foreign labor and production, the U.S. in aggregate will feel less impact if a trade war with China ignites.

U.S. Trade Deficit with China Is the Lowest Since 2010

Trump 2.0 Dynamics Are Much Different Than Trump 1.0

* U.S. trade balance with China

Source: LPL Research, Census Bureau, 11/12/2024

Conclusion

In general, a tax from tariffs or any other policy, creates a deadweight loss to the economy. Businesses and consumers feel the impact; employment typically shrinks and our foreign trading partners often retaliate. Among potential positive impacts from these types of trade wars are the negotiating opportunities, potentially further shifts toward U.S. production, and maybe some humanitarian improvements as well. Perhaps trade threats could punish foreign businesses who exploit their workers with inhumane working conditions. We could hope the world becomes a safer and fairer place, even for workers in other parts of the globe.

As it relates to the investment outlook, markets are right to have caution as we enter 2025. There are economic headwinds, but so far, a stable consumer, looser Fed policy, and businesses planning to ramp up capital expenditures now that election uncertainty has lifted may keep supporting this market.

Asset Allocation Insights

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities, with a preference for the U.S., a slight tilt toward growth, and benchmark-like exposure across the market capitalization spectrum. However, we do not rule out the possibility of short-term weakness, especially as geopolitical threats in the Middle East escalate. Equities may also readjust to what we expect will be a slower and shallower Fed rate-cutting cycle than markets are currently pricing in, although both post-election and fourth-quarter seasonality are favorable for stocks.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet or Bloomberg.

This material was prepared by LPL Financial, LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0002171-1024W Tracking #659053 (Exp. 11/25)